All Categories

Featured

Table of Contents

TIAA may supply a Loyalty Benefit that is only offered when electing lifetime revenue. Annuity agreements might have terms for keeping them in pressure. TIAA Conventional is a set annuity product provided via these agreements by Teachers Insurance and Annuity Organization of America (TIAA), 730 Third Opportunity, New York, NY, 10017: Kind series consisting of but not restricted to: 1000.24; G-1000.4; IGRS-01-84-ACC; IGRSP-01-84-ACC; 6008.8 (vanguard annuity quotes).

Converting some or every one of your cost savings to income advantages (described as "annuitization") is an irreversible decision. As soon as earnings advantage settlements have started, you are unable to alter to another alternative. A variable annuity is an insurance agreement and includes underlying investments whose value is linked to market efficiency.

Buying An Annuity With An Ira

When you retire, you can pick to receive income forever and/or various other income alternatives. The real estate market undergoes numerous risks consisting of changes in underlying residential or commercial property worths, expenditures and revenue, and prospective ecological responsibilities. In basic, the worth of the TIAA Property Account will fluctuate based on the underlying worth of the direct actual estate, real estate-related investments, genuine estate-related securities and liquid, set income investments in which it spends.

For a more full discussion of these and various other risks, please speak with the syllabus. Liable investing incorporates Environmental Social Administration (ESG) elements that may impact exposure to issuers, markets, industries, restricting the type and number of financial investment chances available, which could result in leaving out financial investments that do well. There is no warranty that a diversified profile will boost general returns or outmatch a non-diversified portfolio.

Annuity Certain Example

Over this same duration, relationship between the FTSE Nareit All Equity REIT Index and the S&P 500 Index was 0.77. Index returns do not mirror a deduction for fees and expenses.

10 TIAA may declare extra quantities of interest and income advantages above contractually assured degrees. When earnings advantage repayments have actually started, you are incapable to transform to an additional alternative.

Nonetheless, it is very important to keep in mind that your annuity's balance will certainly be decreased by the income settlements you obtain, independent of the annuity's efficiency. Earnings Test Drive income payments are based upon the annuitization of the amount in the account, period (minimum of one decade), and other factors selected by the participant.

Annuitization is irrevocable. Any warranties under annuities issued by TIAA go through TIAA's claims-paying capacity. Passion over of the assured amount is not guaranteed for periods apart from the durations for which it is declared.

Check today's listings of the finest Multi-year Guaranteed Annuities - MYGAs (upgraded Sunday, 2024-12-01). For specialist aid with multi-year guaranteed annuities call 800-872-6684 or click a 'Obtain My Quote' button following to any type of annuity in these listings.

You'll also appreciate tax advantages that savings account and CDs don't use. Yes. In many cases deferred annuities enable a total up to be taken out penalty-free. The allowable withdrawal amount can differ from company-to-company, so be sure to review the product sales brochure very carefully. Deferred annuities usually permit either penalty-free withdrawals of your gained rate of interest, or penalty-free withdrawals of 10% of your agreement worth every year.

Aig Annuity Insured

The earlier in the annuity period, the greater the fine percent, referred to as abandonment costs. That's one reason that it's best to stick with the annuity, when you commit to it. You can pull out every little thing to reinvest it, yet before you do, make certain that you'll still triumph this way, even after you figure in the abandonment cost.

The surrender charge can be as high as 10% if you surrender your contract in the very first year. Often, the surrender cost will certainly decline by 1% each contract year. A surrender charge would be credited any type of withdrawal better than the penalty-free amount permitted by your postponed annuity contract. With some MYGAs, you can make very early withdrawals for emergency situations, such as health expenses for a major health problem, or confinement to a nursing home. fixed annuity cost.

As soon as you do, it's best to persevere throughout. You can set up "methodical withdrawals" from your annuity. This indicates that the insurance coverage firm will send you settlements of passion monthly, quarterly or yearly. Utilizing this approach will not use your original principal. Your various other choice is to "annuitize" your delayed annuity.

Lots of postponed annuities allow you to annuitize your contract after the initial agreement year. Passion made on CDs is taxed at the end of each year (unless the CD is held within tax qualified account like an Individual retirement account).

The interest is not exhausted up until it is eliminated from the annuity. In various other words, your annuity grows tax deferred and the rate of interest is intensified each year.

Prior to pulling cash out of a MYGA early, take into consideration that one of the major advantages of a MYGA is that they grow tax-deferred. Chris Magnussen, licensed insurance representative at Annuity (annuity plan returns).org, explains what a taken care of annuity is. A MYGA provides tax deferral of rate of interest that is intensified on a yearly basis

Annuities Payments

It's like investing in an IRA or 401(k) yet without the payment limitations.

It exists with traditional fixed annuities. The major distinction in between traditional set annuities and MYGAs is the period of time that the agreements assure the set passion rate.

You may purchase an annuity with a seven-year term however the price might be guaranteed just for the very first 3 years. Discover just how to shield your nest egg from market volatility.

Contrasted to financial investments like supplies, CDs and MYGAs are safer yet the rate of return is lower. A CD is released by a financial institution or a broker; a MYGA is an agreement with an insurance coverage business.

Annuity Age Restriction

A CD may have a reduced rate of interest rate than a MYGA; a MYGA might have more costs than a CD. CD's may be made offered to lenders and liens, while annuities are shielded versus them.

Offered the traditional nature of MYGAs, they could be a lot more ideal for consumers closer to retirement or those that prefer not to be subjected to market volatility. "I turn 62 this year and I truly want some kind of a set rate as opposed to bothering with what the securities market's going to do in the next one decade," Annuity.org client Tracy Neill said.

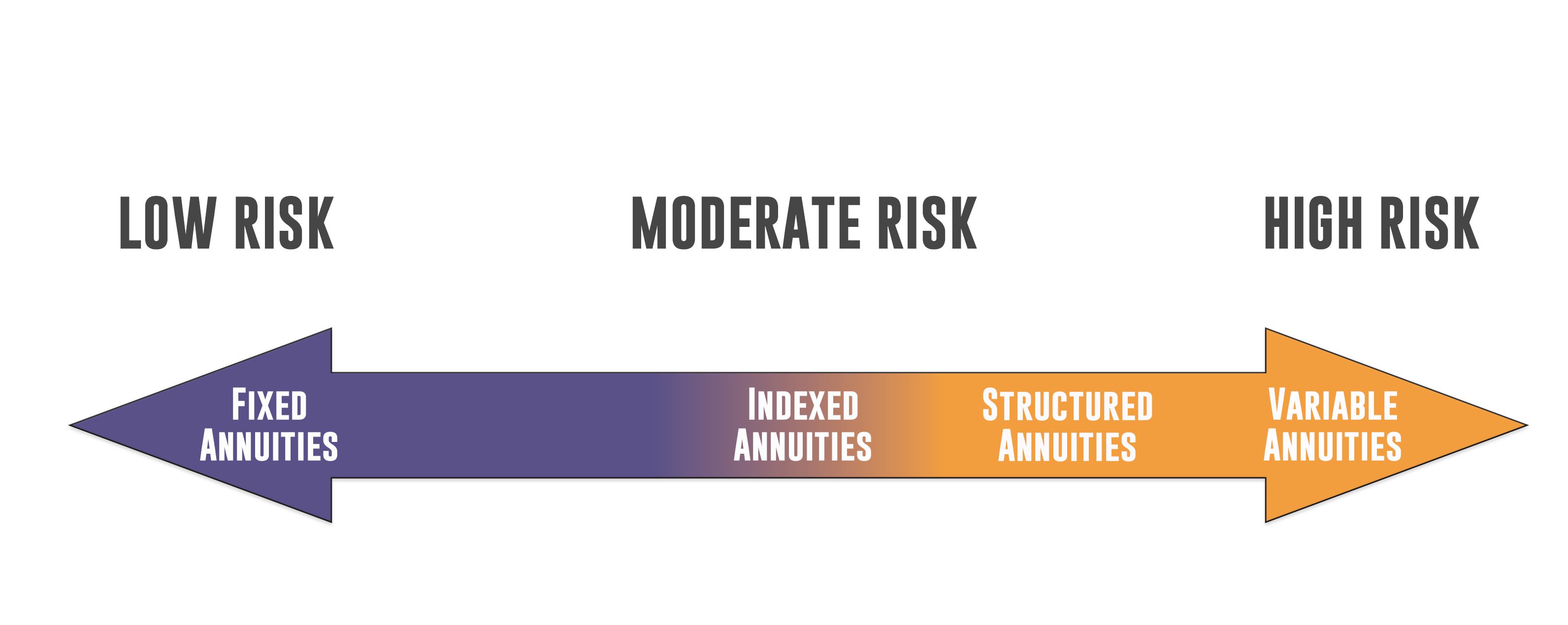

For those who are wanting to outpace rising cost of living, a MYGA could not be the very best monetary approach to meet that purpose. If you are trying to find an option to replace your earnings upon retired life, various other sorts of annuities may make even more feeling for your economic objectives. Additionally, other kinds of annuities have the potential for higher incentive, yet the threat is higher, also.

Much better understand the actions entailed in purchasing an annuity. They use moderate returns, they are a secure and trusted investment alternative.

Prior to pulling cash out of a MYGA early, take into consideration that one of the significant benefits of a MYGA is that they expand tax-deferred. Chris Magnussen, certified insurance policy representative at Annuity.org, clarifies what a taken care of annuity is. A MYGA offers tax obligation deferment of rate of interest that is compounded on an annual basis.

It resembles investing in an individual retirement account or 401(k) yet without the payment limitations. The tax obligation regulations modification somewhat depending upon the type of funds you use to buy the annuity (annuity with highest monthly income). If you acquire a MYGA with qualified funds, such via an individual retirement account or various other tax-advantaged account, you pay revenue tax obligation on the principal and passion when you take out money, according to CNN Cash.

Who Insures Annuities

It exists with typical fixed annuities. The main difference in between conventional fixed annuities and MYGAs is the period of time that the contracts ensure the set rate of interest price.

You may acquire an annuity with a seven-year term but the price might be assured just for the initial 3 years. Discover how to secure your nest egg from market volatility.

Compared to financial investments like supplies, CDs and MYGAs are more secure yet the price of return is reduced - what does annuitizing an annuity mean. A CD is issued by a financial institution or a broker; a MYGA is a contract with an insurance policy business.

A CD may have a reduced interest price than a MYGA; a MYGA might have much more fees than a CD. CD's may be made available to financial institutions and liens, while annuities are shielded versus them.

Provided the conventional nature of MYGAs, they may be better for customers closer to retirement or those that prefer not to be based on market volatility. "I turn 62 this year and I truly want some type of a fixed rate rather than worrying about what the stock market's going to do in the next ten years," Annuity.org customer Tracy Neill said.

Annuities Rankings

For those that are looking to surpass inflation, a MYGA might not be the finest monetary technique to fulfill that goal. Various other types of annuities have the capacity for higher incentive, but the danger is greater, as well.

Better understand the steps associated with purchasing an annuity. Multi-year guaranteed annuities are a type of fixed annuity that offer guaranteed rates of return without the danger of securities market volatility. Though they supply modest returns, they are a safe and reliable financial investment option. A market price modification is a function an annuity company might include to protect itself against losses in the bond market.

Table of Contents

Latest Posts

Understanding Financial Strategies Everything You Need to Know About Variable Annuity Vs Fixed Annuity Defining the Right Financial Strategy Benefits of Variable Annuity Vs Fixed Annuity Why Choosing

Understanding Fixed Annuity Vs Equity-linked Variable Annuity Key Insights on Your Financial Future Breaking Down the Basics of Variable Vs Fixed Annuity Benefits of Choosing the Right Financial Plan

Current Annuity Rates Us

More